It’s a common question for merchants, “How do I accept credit card payments without a merchant account?” Is it even possible? Well, yes! It is—through a non-dedicated account that isn’t distinctive to your business.

It’s important to remember there are advantages and disadvantages to credit card processing without a merchant account.

And that’s the purpose of our feature, to guide you through the steps you need to follow. Plus, to see if it’s a good idea for you to do. Let’s begin with the basics.

What’s a merchant account?

It’s a type of bank account and it allows businesses to accept online payments from your customers.

This is usually from credit or debit cards, but now there are many alternative payment methods supported.

To get a merchant account, you join a provider by applying for a contract.

Is it hard to get a merchant account?

No, it isn’t hard to get a merchant account. These days it’s easier to do than ever before.

To get started, you’ll need to get together documentation about the type of business you have. It needs to include details of your risk management, how long your business has run for, the stability of your finances, and personal credit history of the owner.

To get a merchant account, what you need to do is:

- Choose a credit card to work with.

- Select a payment model.

- Gather your turnover data.

- Choose a local bank.

- Ensure your website is fully prepared.

- Get your business documents and submit an application.

It’s quite cost-effective to do so, with most providers charging a monthly fee of around $10-$30.

But if you want to get around this process, you can legitimately do it through the following steps.

How to accept credit cards online without a merchant account

It’s a common question for many e-commerce business owners, “How can I sell online and accept credit cards without a merchant account?” If you don’t want a merchant account, then you’ll need an intermediary solution.

To accept credit card payments without a merchant account, the process begins with signing up to a third-party payment provider. These are also called a:

- Payment service provider (or a global payment gateway).

- Payment facilitator.

- Processing aggregator.

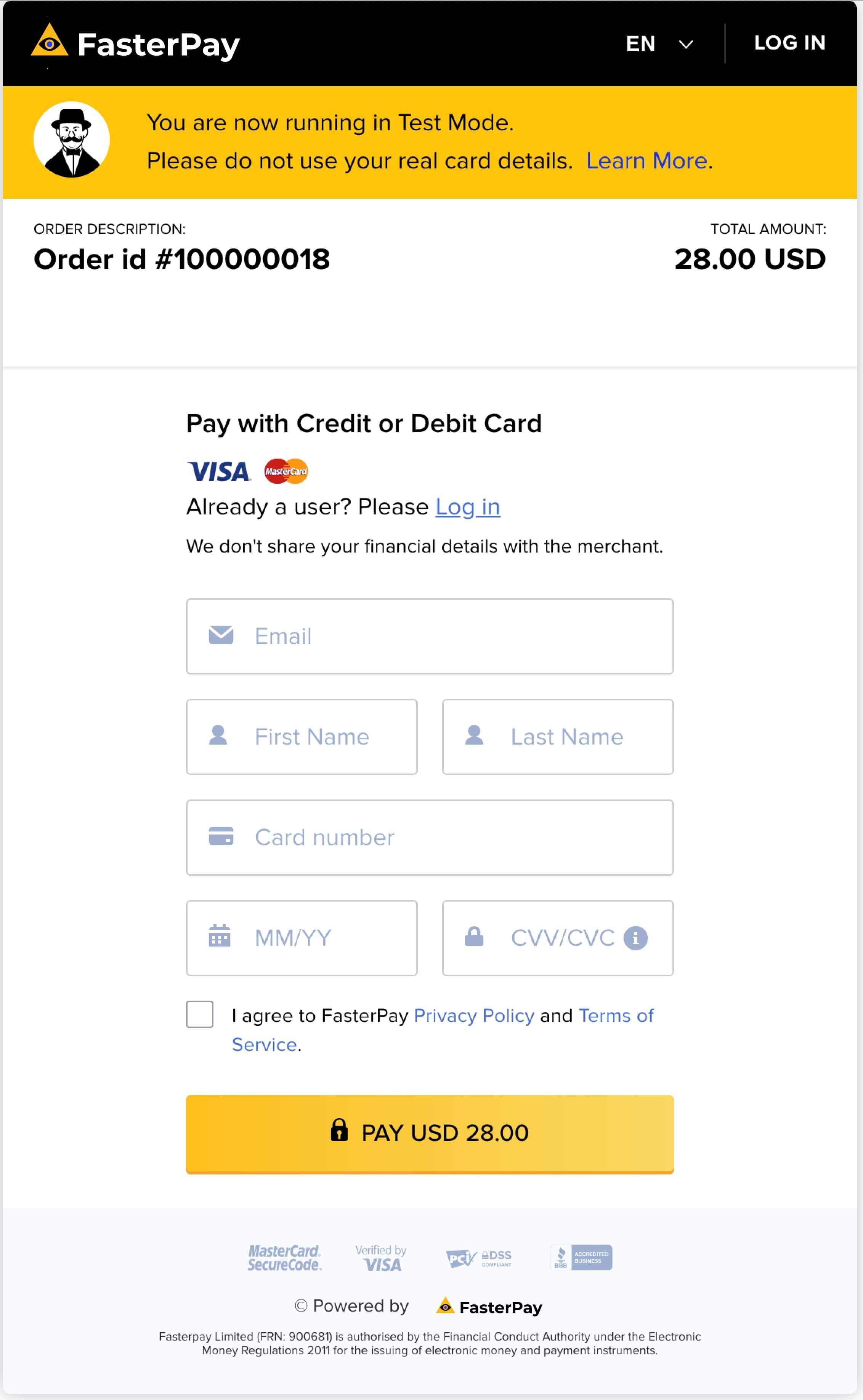

These let you accept credit card payments through their service—they aggregate a customers’ money into a merchant account and then transfer that into one business bank account. That's with online checkouts such as this.

FasterPay is an example. We feature a built-in merchant account that aggregates a customer’s funds into one account that’s then later sent to a business bank account.

When considering a third-party payment aggregator, you’ll need to factor in the services they provide. These should focus on:

- Security: Ensuring the right level of transaction safety. The right process will have an instant authorization of customers, encryption of financial data, and financial conduct certificates.

- Payment flexibility: Checking for a transparent payment policy without any hidden fees, plus the added bonus of recurring payment options.

- Convenience: An accessible user interface for clients and merchants.

- Customer support: Look for 24/7 support so your business will have the constant access to guidance that’s often necessary.

- Speed and reliability: A trustworthy and proficient system and service that enables global transactions with ease.

And you can use alternative payment methods as part of this payment aggregator process.

While credit/debit cards are common, more and more customers will want access to more flexible and convenient payment methods. Such as a digital wallet.

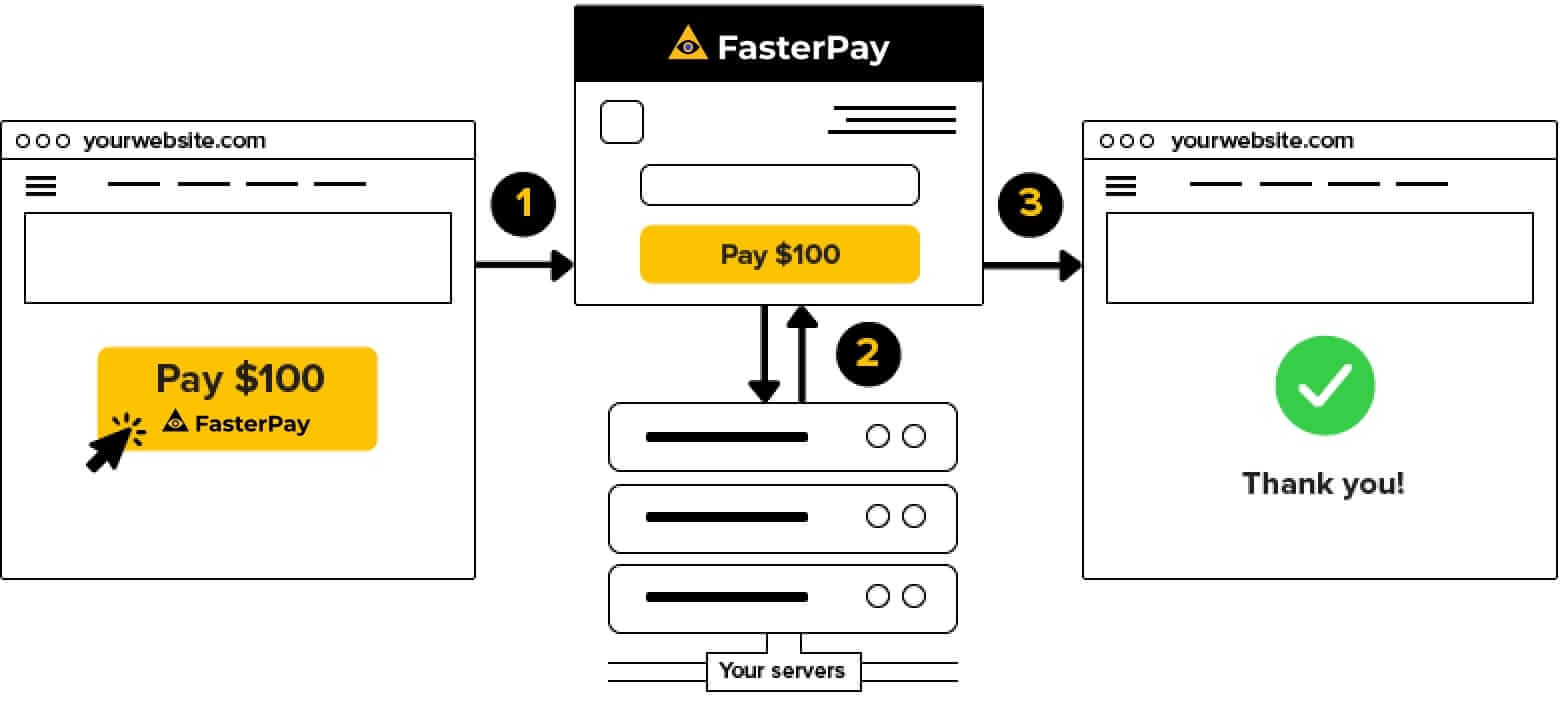

How FasterPay works for your business

So, want to accept credit cards online without a merchant account? Then FasterPay is an excellent option for you.

We provide a seamless payment platform that enables your business to take transactions without a merchant account. It’s easy to setup and provides your business with:

- Generated pay buttons by copy and pasting HTML into your website.

- Multi-currency global payment processing.

- A seamless checkout page to take care of your customer’s transactions.

- Recurring billing with our subscriptions.

- Plugins like WHMCS, Shopify, Magento, and WooCommerce.

- FasterPay Android SDK to make app payments easier.

- Seamless and secure payment processing.

- Exclusive business tools and features.

- Maximized revenue.

- Lower churn rates.

FasterPay makes accepting credit card payments without a merchant account straightforward and takes the hassle out of managing customer transactions by simplifying the process.

We also have a full FasterPay for business guide you can check out for further information.

The advantages and disadvantages of a third-party merchant account

It’s a good option if you’re a small business looking to avoid any opening fees.

For example, if you’re bringing in less than $1,000 p/m in transactions and don’t want large upfront fees, a third-party merchant account is a great idea.

Another considerable benefit is third-party providers won’t usually expect a credit check. So if your business has a history of low credit scores, you can overcome this problem.

However, if you take this approach you may find the third-party provider takes a higher percentage for every transaction you take.

This means, in the long-term, you may find it more viable to get a merchant account and overcome the initial setup fees and other charges.

It may provide more ROI, so weigh up your options before deciding on the best approach for your business.

Time to start using FasterPay

Setting up FasterPay is safe, secure, and ultra-fast. You can find the FasterPay pricing plans to see the charges involved. The app is available on:

You can also create a desktop FasterPay business account.

Any questions? There’s our 24/7 customer support team: support@fasterpay.com.